By: Options Master

Navigating the volatile landscape of technology stocks can be a profitable endeavor with the right strategies in hand. For those interested in trading options on NVIDIA Corporation (ticker: $NVDA), employing the Darvas Box Technique provides a structured yet dynamic approach to capitalize on the stock’s rapid growth phases. Here’s how you can use Nicolas Darvas’ legendary stock trading strategy to trade $NVDA options effectively.

Step 1: Identifying Optimal Trading Phases for $NVDA

To effectively apply the Darvas Box technique to $NVDA options, start by identifying when the stock demonstrates a strong upward trend accompanied by robust trading volume. This typically occurs when NVIDIA is reaching consistent new highs and the broader technology sector shows signs of strength.

Step 2: Constructing Darvas Boxes

Utilize reliable stock charting software to draw Darvas Boxes for $NVDA. Each box encapsulates a range where the stock has moved sideways before achieving a breakout. The top boundary serves as resistance, and the bottom as support. This visualization aids in pinpointing strategic entry points for options trading.

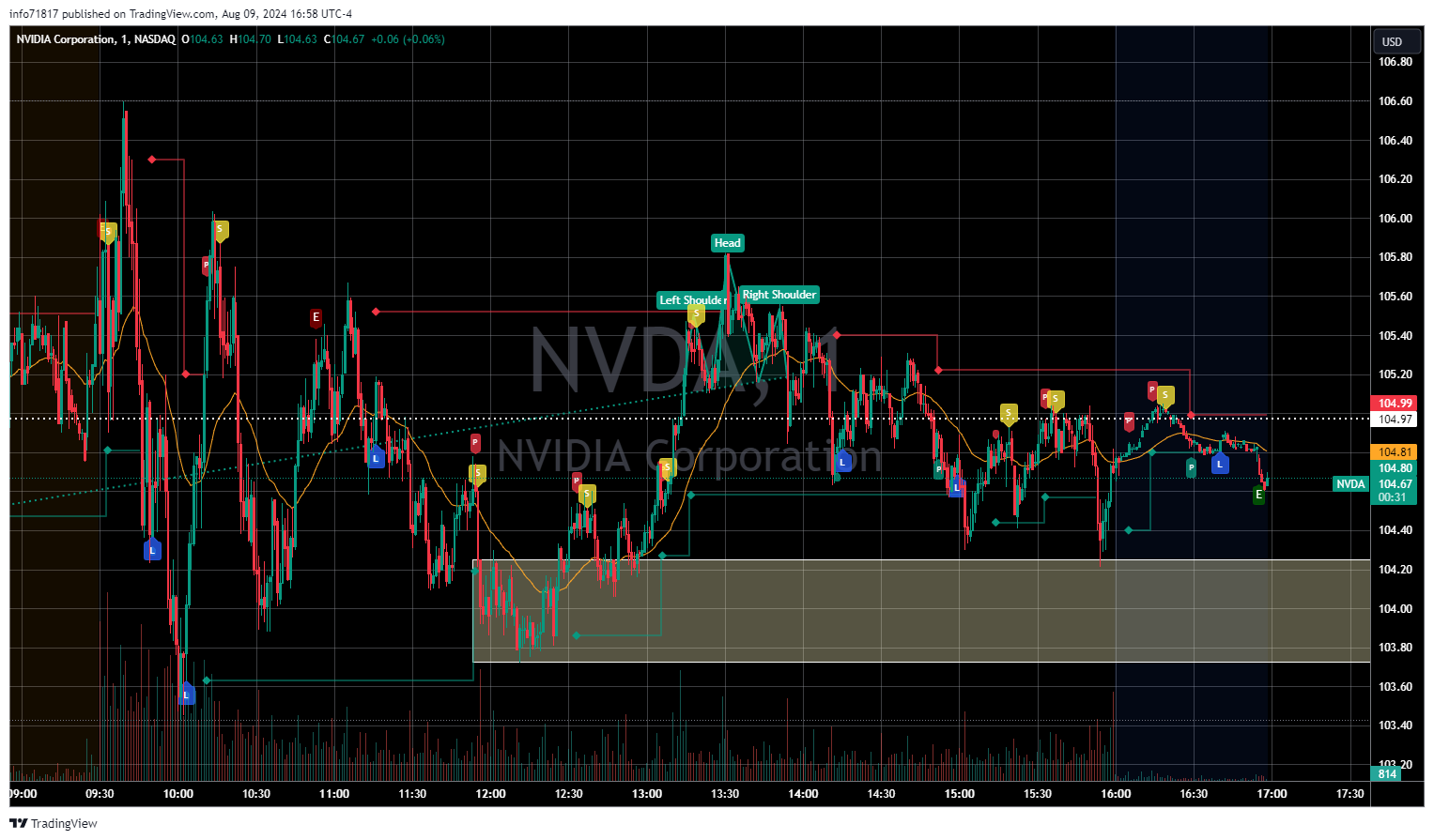

From the chart below, $NVDA developed a very distinct pattern after the ICB (Initial Cash Balance) session between 9:30 and 10:30 am establishing the day’s high and low prices. As the market settled down and $NVDA drifted to the lower levels around noon, we see the short sellers covering their positions and buyers stepping in. This is where the box trade was established and $NVDA 104 Calls were purchased near the low of day. As the stock price increased to extended levels, there was a slight pullback followed by a nice pop to the upside all while developing a distinct Head and Shoulders pattern which is generally followed by a drop in the stock price. This was the ideal area to take profits by closing out the 104 calls. As you can see for the rest of the day, the stock price movement was muted and did not present any more meaningful long or short opportunities.

Step 3: Selecting Suitable Options Strategies

Upon observing a breakout above the upper boundary of a Darvas Box, consider employing bullish options strategies:

- Buying Calls: Opt for a call option with a strike price slightly above the current stock price, ensuring the expiration date provides ample time for the trade to unfold, typically a few months ahead.

- Bull Call Spreads: Implement a spread by purchasing a call at or above the current stock price and selling a higher-strike call to reduce the investment cost. This strategy is designed to maximize gains from upward movements in $NVDA’s price with minimized upfront costs.

Step 4: Implementing Stop Loss Strategies

Leverage the structure of the Darvas Boxes to set strategic stop losses. For instance, if $NVDA’s price retracts back into the box, it may indicate a weakening momentum, warranting an exit or adjustment of your options position. This is usually a change in sentiment and would be better served by buying put options versus call options.

Step 5: Dynamic Monitoring and Adjustment

Monitor $NVDA’s price action continuously as new boxes form, adjusting your options positions accordingly. For call purchases or spreads, consider locking in profits or reassessing your strategy if the stock price retracts or continues to rise beyond new box formations.

Step 6: Profiting from Market Trends

Given NVIDIA’s propensity for rapid price changes, be prepared to act swiftly. If the stock significantly exceeds expectations or if there’s a spike in implied volatility, these could be opportune moments to realize gains from your options positions.

Conclusion

The Darvas Box Technique offers a systematic method to engage with $NVDA options, blending meticulous technical analysis with the strategic flexibility of options trading. While this approach provides a clear framework for entry and exit, it’s crucial to remember that options trading involves risks and demands consistent risk management and learning. This strategy is best suited for those who are well-acquainted with the nuances of options markets and are prepared to actively manage their trades.

By following these steps, you, too, can harness the potential of NVIDIA’s dynamic stock movements through a well-planned options trading strategy. Happy trading!

Options Trading Disclaimer:

Options trading involves significant risk and is not suitable for every investor. The value of options can fluctuate unpredictably, potentially leading to substantial losses, including the total loss of the amount invested. Options trading privileges are subject to review and approval. Not all investors will qualify.

Before engaging in options trading, it is crucial to fully understand the risks involved. This includes the potential for rapid and substantial losses due to market movements and leverage. Investors must be aware of their financial capability to bear the risks of options trading and should only invest money that they can afford to lose.

The information provided here is for educational and informational purposes only and should not be construed as investment advice, a recommendation, or an endorsement of any particular security or strategy. All investments involve risk, and past performance is not indicative of future results.

Investors should consult with a qualified financial advisor or conduct their own due diligence before making any investment decisions involving options. By using this information, you agree that the author and publisher are not responsible for any losses connected with recommendations or views expressed.

Please remember to trade responsibly and consider your investment objectives and consultation with a financial professional before trading.

Copywrite © 2024 Options Master, Inc. – No part of this blog shall be reproduced without written consent from Options Master, Inc.

Leave a Reply