Options trading can be a high-reward investment strategy, but it also carries its own set of risks, especially when dealing with complex instruments like naked long calls. In this blog, we will delve into what naked long calls entail and the potential advantages and disadvantages associated with this type of trading strategy.

What are Naked Long Calls?

A “naked long call” strategy involves buying call options without owning the underlying stock or other protective options. This strategy is based on the expectation that the price of the underlying asset will rise significantly before the expiration of the option, allowing the trader to profit from the increase in the stock price minus the premium paid for the call.

Pros of Trading Naked Long Calls

- Leverage: One of the biggest advantages of buying naked long calls is the leverage they provide. Traders can control a large amount of stock for a relatively small initial investment (the premium paid for the call option). This allows for significant potential returns if the stock price increases above the strike price by more than the cost of the premium.

- Limited Risk: The risk is limited to the amount of the premium paid for the call options. Unlike selling naked calls, where the risk is unlimited, buying calls caps the potential loss at the initial investment, making it a more palatable option for risk-averse investors.

- High Profit Potential: If the underlying asset’s price soars above the strike price, the profit potential can be quite substantial. The higher the rise in the asset’s price, the greater the potential profit, limited only by the asset’s price increase and the time left until the option expires.

- Simplicity: Compared to other options strategies that involve multiple positions or require managing sold options, buying a naked long call is relatively straightforward.

Cons of Trading Naked Long Calls

- Time Decay: Options are time-sensitive instruments, which means they lose value as they approach their expiration date. This is known as time decay, and it is an inherent disadvantage in buying options. If the stock price does not increase above the strike price quickly enough, the option may expire worthless.

- Requires Accurate Prediction: This strategy hinges on the stock price rising above the strike price before the option expires. If the anticipated increase in the stock price does not occur, the option will expire worthless, resulting in a 100% loss of the premium.

- Volatility Dependence: The success of naked long calls often depends on market volatility. Low volatility can lead to smaller price movements, which may not be sufficient to make the option profitable.

- Opportunity Cost: The premium paid for buying the call option could be used elsewhere. If the call option does not perform as expected, the trader not only loses the premium but also the potential gains that could have been made through other investments.

Conclusion

Trading naked long calls can be an attractive option for traders looking for high leverage and substantial profit opportunities with limited risk. However, the need for precise market timing, susceptibility to time decay, and total dependence on significant price movements make it a risky strategy that requires careful consideration and market analysis. As with any trading strategy, it’s important to understand your own risk tolerance and to consider whether the potential rewards justify the risks involved.

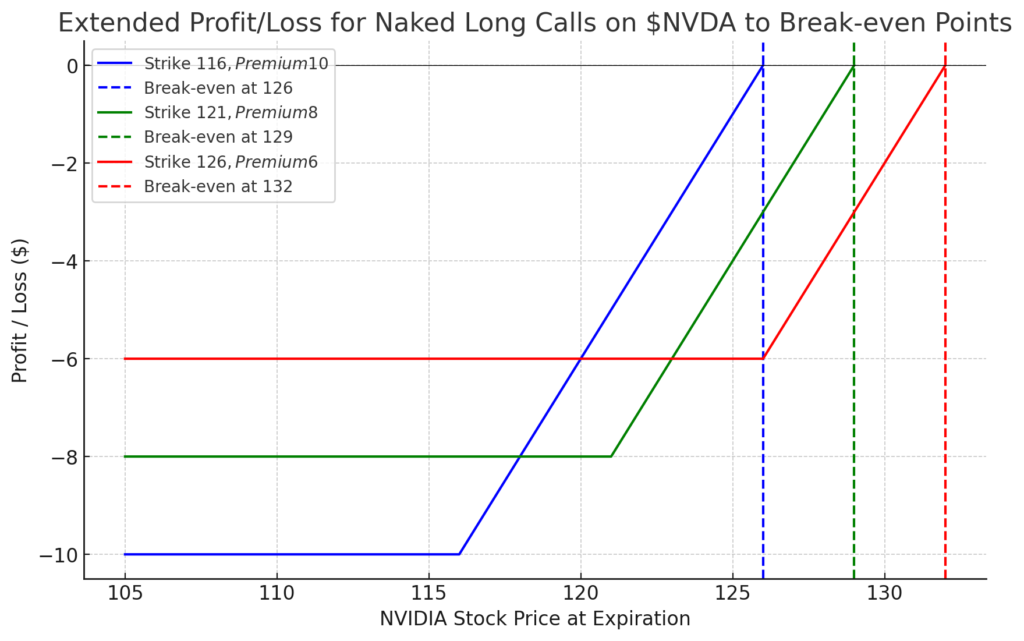

Here’s an example of 3 different strike prices for NVIDIA stock trading at $116 and how to calculate break even at expiration.

Strike 116 has $10 in time premium and $NVDA stock must trade greater than or equal to $126 at expiration to break even or make a profit.

Strike 121 has $8 in time premium and $NVDA stock must trade greater than or equal to $129 at expiration to break even or make a profit.

Strike 126 has $6 in time premium and $NVDA stock must trade greater than or equal to $132 at expiration to break even or make a profit.

*Keep in mind that any time before expiration the option can be sold for either a profit or loss. If the option is allowed to be exercised at expiration, the buyer must have the funds necessary to purchase the underlying stock based upon the number of contracts originally purchased i.e. (1 contract equals 100 shares of the underlying stock).

Options Trading Disclaimer:

Options trading involves significant risk and is not suitable for every investor. The value of options can fluctuate unpredictably, potentially leading to substantial losses, including the total loss of the amount invested. Options trading privileges are subject to review and approval. Not all investors will qualify.

Before engaging in options trading, it is crucial to fully understand the risks involved. This includes the potential for rapid and substantial losses due to market movements and leverage. Investors must be aware of their financial capability to bear the risks of options trading and should only invest money that they can afford to lose.

The information provided here is for educational and informational purposes only and should not be construed as investment advice, a recommendation, or an endorsement of any particular security or strategy. All investments involve risk, and past performance is not indicative of future results.

Investors should consult with a qualified financial advisor or conduct their own due diligence before making any investment decisions involving options. By using this information, you agree that the author and publisher are not responsible for any losses connected with recommendations or views expressed.

Please remember to trade responsibly and consider your investment objectives and consultation with a financial professional before trading.

Copywrite © 2024 Options Master, Inc. – No part of this blog shall be reproduced without written consent from Options Master, Inc.

Leave a Reply